If you’re going to live, leave a legacy. Make a mark on the world that can’t be erased.

Maya Angelou

Legacy is SO MUCH MORE than money.

Your Life. Your Legacy.

Legacy Planning is a more holistic approach to estate planning. It goes beyond traditional estate planning and takes a comprehensive and deliberate approach, which seeks to secure your total wealth, manage its distribution after your passing, and ultimately, preserve your legacy. It’s all about creating a definitive plan to leave your mark on the world and pass on your legacy to the next generation. Your estate is made up of both financial and non-financial assets such as real estate, investments, business interests, insurance proceeds, retirement accounts, and personal property. In addition, your legacy also encompasses important decisions that ensure your family’s core values, beliefs, and community involvement, are passed on for generations to come.

We are committed to you and your Legacy Planning, as this is a robust way of preserving your legacy. It offers a sense of security and peace of mind knowing that your personal effects, family heirlooms, and stories will continue to be cherished according to your wishes. By documenting your core values and life lessons, you will inspire future generations to uphold your unique legacy. Imagine the peace of mind that comes with knowing that your legacy is protected and secure! With Legacy Planning, you can rest easy knowing that everything you own will be distributed according to your wishes. Take charge of your legacy today and let us help you preserve the things that matter most.

3 Estate/Legacy Planning Questions to Answer Today

1. Do you have an estate plan you trust?

It’s critical that you feel confident in your estate plan. This will give you and your loved ones peace of mind today and in the future.

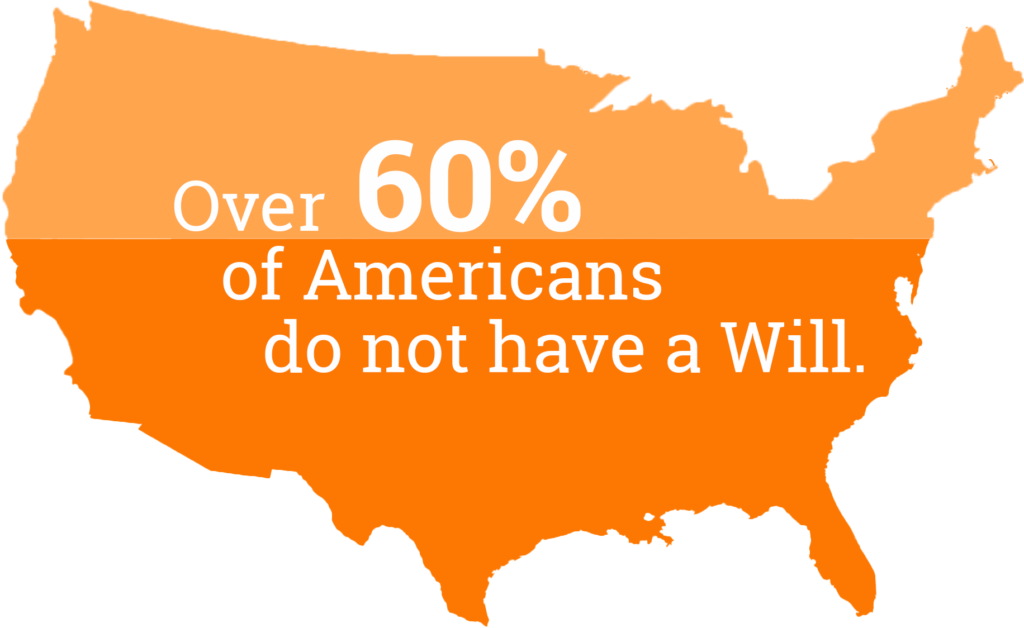

If you have any concerns about your estate plan, no matter how big or small they may be, take the steps necessary to regain control of your situation. And of course, if you don’t have an estate plan, now’s the time to create one.

2. When was the last time you reviewed your estate plan?

Situations, needs, and the law all change over time. Don’t assume that the first estate plan you create is the one that will remain in place until your death. Instead, you must realize that regular reviews and alterations are a must.

If you don’t know the last time you reviewed your estate plan, it’s been too long. Take the time to carefully review each and every detail, ensuring that they’re still relevant to your current circumstances and future goals.

3. Does your estate plan touch on all your questions and concerns?

Anyone can create a basic estate plan, but that doesn’t mean it’ll satisfy all your questions and concerns. As you review your estate plan, you’ll come to better understand if it “checks all the boxes” for you, your family, your estate, and your lasting legacy.

For example, you may have questions and concerns related to incapacity planning, long-term care planning, disability care, and insurance. Or you may be concerned that your children could lose part of their inheritance in a divorce.

An estate plan that touches on all your questions and concerns is one that you can feel good about.

If you’re worried about your estate plan and have questions and concerns, you’re in the right place. Contact us via phone at (301) 856-5550 or set an appointment here. We’re here to answer your questions, address your concerns, and help you in any other way possible.

Download Our FREE Estate Planning Worksheet

By providing this information, you are agreeing to receive texts at the number provided from Ellevation Wealth Management and Legacy Planning, LLC. Frequency may vary and include information on appointments, events, and other marketing messages. Message/data rates may apply. To opt-out, text STOP at any time.

It’s not just about leaving your assets to your loved ones; it’s about giving them the tools to carry on your legacy that will live on for generations to come. So, take control of your wealth and ensure that your legacy is preserved, respected, and celebrated as a symbol of your life and achievements. You deserve it.

Helping you articulate what lasting legacy you want to leave.

As you plan for your future, it’s important to consider what you want to pass on to future generations. Whether it be your children, grandchildren, or other beneficiaries, you may have specific goals in mind. Additionally, you may wish to make an impact on institutions, religious organizations or charities that have had a profound influence on your life.

Our team can assist you in creating an Ethical Will, an integral component of your Legacy plan, where you can articulate your values, hopes, and dreams for your loved ones. We believe in discussing important topics such as what you want your family to learn from your life experiences, the beliefs you hold about the important things in life, your desires for how the inheritance will be used, and the values and traditions you want to impart to your family.

By creating an Ethical Will, you will have the opportunity to leave a meaningful gift for your heirs, one that embodies your final grant of love and support as their caregiver for life. Because we understand you, we’re the perfect partner to walk you through the Legacy process and help you craft clear instructions for what comes next.