Federal Government Employees

As a Federal Employee, your retirement and benefits are COMPLEX.

Federal government employees’ benefits are particularly complex and few advisors truly have an in-depth knowledge. Finding a financial planner that specializes in Federal Employee benefits to work with can be a daunting task, but Ellevation is here to simplify that for you! We’ve spent decades educating ourselves and continuously receive specialized training to become your number one resource. We work with employees from a number of agencies in the DMV and all over the country and have a thorough understanding of their often-nuanced retirement options. We can help you understand your options and create a financial plan to achieve your goals now and in retirement. If you’re ready to take control of your finances and create a plan for your future, let’s talk.

Our Expertise Includes:

Pensions

We have helped federal government employees understand their pension options under both the Civil Service Retirement Act (CSRS) and the Federal Employee Retirement System (FERS). We will work one on one with you to analyze your potential retirement scenarios, including early retirement, using a FERS Supplement, and how your pension interacts with Social Security.

Thrift Savings Plan (TSP) Options

We will collaborate with you in selecting the best TSP strategy in light of your overall situation and retirement goals. The Thrift Savings Plan is a key part of your Federal Government retirement benefits. Make sure you understand your options and, more specifically, which options work best for you. We can help provide you clarity and confidence so you can live your best life now and during retirement and leave a lasting legacy for generations to come.

Insurance

As a federal government employee, you have access to the largest group life insurance program in the world, the Federal Employees’ Government Life Insurance (FEGLI). We will help you determine whether you need coverage in retirement, and if so, identify the coverage available to you as a retiree so you can select the optimal combination for your situation.

Early Retirement

If you are a federal employee considering early retirement, we will work with you to determine if early retirement is feasible and, if so, draft a road map to get you there. As part of our planning, we will help you create a budget for retirement, calculate your retirement income, and address potential red flags such as age and TSP restrictions.

Your Personalized Plan

Whether you plan to retire early or not, we will build a financial plan to help you achieve your goals. Beyond the benefits specific to federal government employees, your comprehensive plan will incorporate your other needs such as budgeting, cash flow, tax planning, and estate planning.

If you are interested in seeing how a federal employee financial advisor can help you make a smooth transition into retirement, please contact us. We offer a complimentary consultation to federal employees and would be happy to talk with you.

Retirement freedom and financial security begin with understanding your Federal Benefits. We’re here to help you every step of the way.

Contact us via phone at 888-ELLEV8N or set an appointment here. We’re here to answer your questions, address your concerns, and help you in any other way possible.

The TSP Optimizer® is a simple, online tool designed to assist you with the management of your Thrift Savings Plan. By helping you properly allocate your account, the system uses your risk tolerance and long-term goals to generate a personalized portfolio and will recommend changes to make to your investment strategy based on market fluctuations.

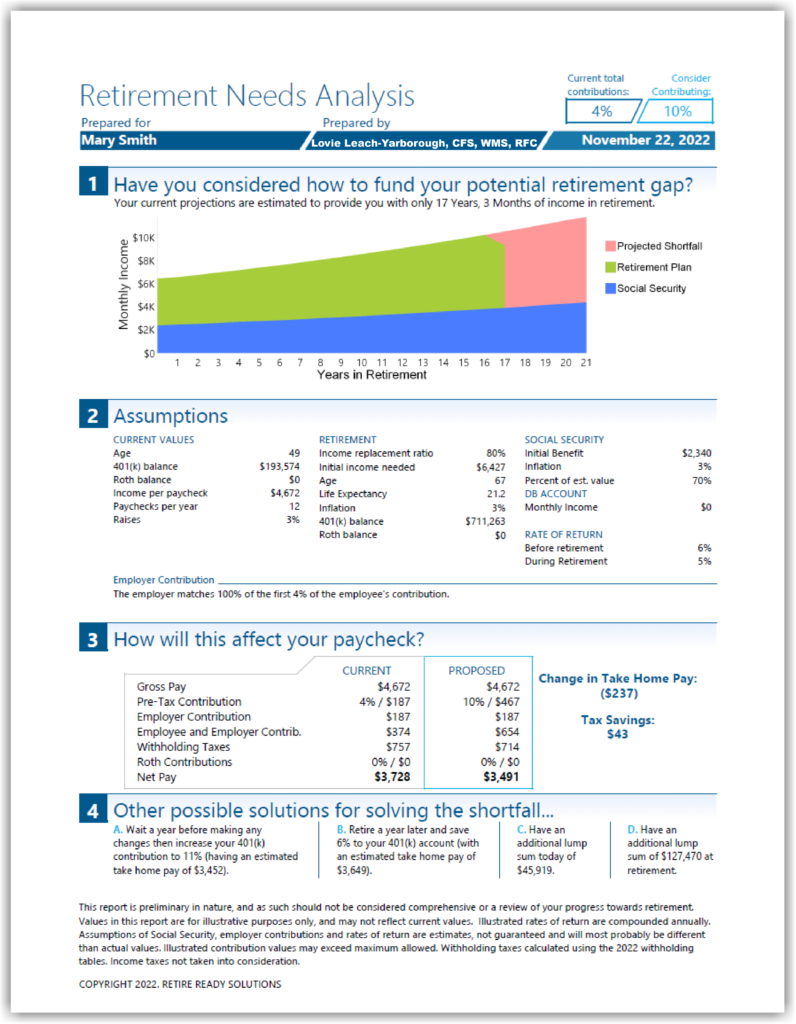

This report is designed to let you see first-hand the critical aspects of your Federal Employee Benefits. Now you can stop the guesswork, charting a path to maximize your benefits.

In this analysis, you will:

- Get detailed calculations and insights into your Employee Benefits.

- See present and future values of your pension, TSP account, Social Security benefits, and FEGLI benefits.

- Receive forecasts for future monthly income, life coverage, survivor benefits, and other benefits at different ages.

- Potentially discover if you can retire earlier than expected.

- Find out if you should work longer to achieve a financially confident retirement.

By providing this information, you are agreeing to receive texts at the number provided from Ellevation Wealth Management and Legacy Planning, LLC. Frequency may vary and include information on appointments, events, and other marketing messages. Message/data rates may apply. To opt-out, text STOP at any time.

SUBSCRIBE

Sign up to hear from us about live events, webinars, and news for federal employees.